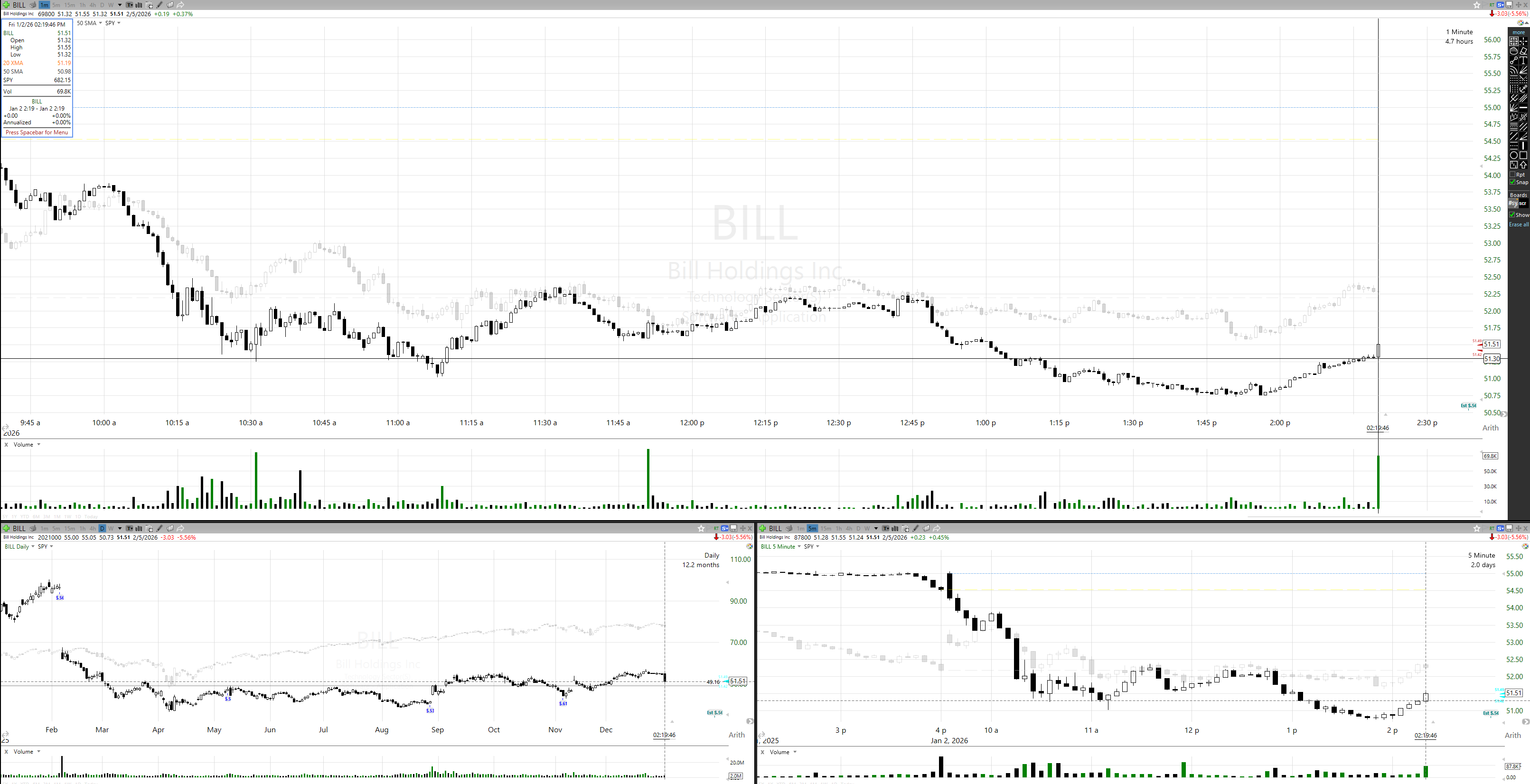

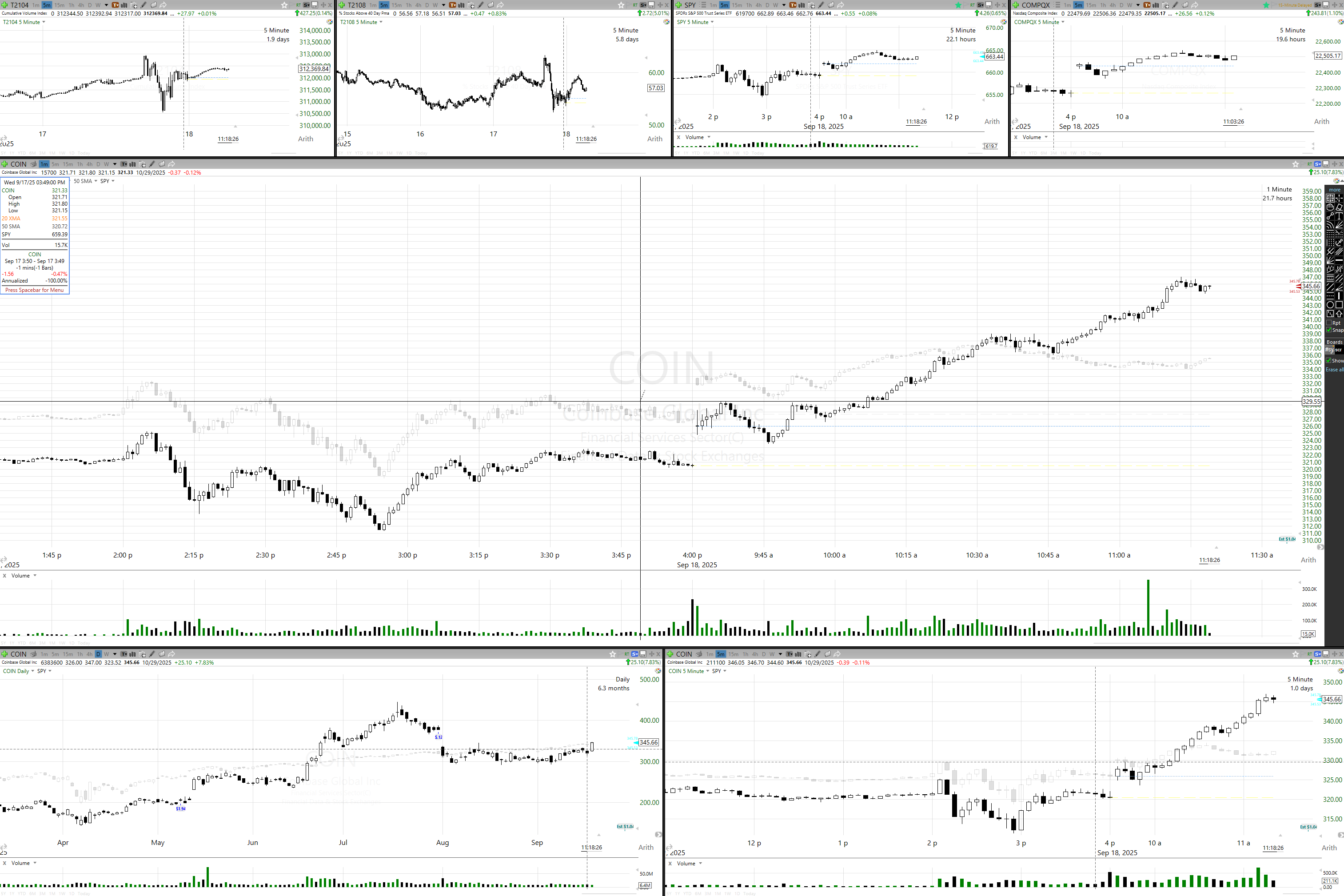

Following are some setups for an intraday compression breakout.

Entry/Stop (green/red inside box).

The setup is predicated on:

- Volatility contraction. I have a script scanning fir these intraday on 1m time scale in TC2000.

- Overall daily direction UP (longs)

- Global level breakout (as in the breakout you're targeting is also breaking level previously established as resistance on D timeframe). This rule can be relaxed, but it helps to filter for strong follow-throughs.

Level break, immediate support (1m), trend up for the rest of the day. 15x move if your R is low of 3 1m candles after 10:07, entry is slightly above.

Similar setup, entry would be 2 candles preceding breakout candle. R is box around them.